The world’s population continues to grow but at a slower pace. This coincides with a rise of “New-age parents” in several countries across the world. The “New-age parents” are instrumental in the shifting global focus on an improved quality of life and growing health awareness.

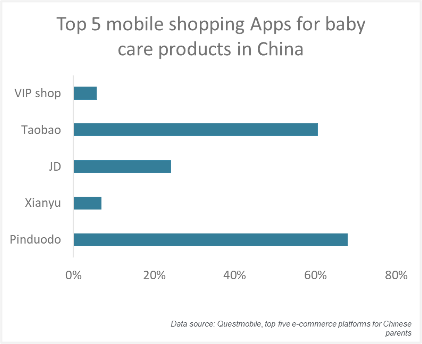

Over the last few years, amidst the two-child policy, China began witnessing an era of “New-age parents” – parents who focus on their careers, health, and leisure. They are ready to pay a premium for convenience. The baby care market in China reflects the changing lifestyle. Estimated at USD$2.01 billion, the baby care market in China is expected to grow at a CAGR of 7% from 2020-2027. The recent 3-child policy (to solve the country’s aging problem) may further spur the baby care product market. The world’s largest e-commerce market is China, which has over 300 million active mobile internet users with children under 12.

The growth of e-commerce sales combined with an increasing demand in baby care products is a both a goldmine and a minefield. It is a minefield because of the counterfeiters who wishes to capture the opportunities by deplorable means. The far-reaching impact of counterfeiting in baby care category extends beyond loss of sales and trade mark dilution. The real risk is the potential harm to the baby’s well-being and as a result, brand integrity. The currently evolving online channels provide a fertile ground for both the brand-owners and the counterfeiters to generate more sales. The counterfeiter can free-ride on the brand’s reputation unless the brand-owners take actions against the counterfeiters. Brand-owners need to pay attention to both the driving forces of the baby care industry in China and the rising threats to the brand.

China is witnessing a rising tide of online shopping across online platforms (e-commerce) and social media channels (social commerce).

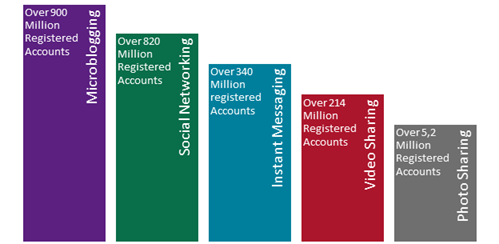

The colossal potential reach on social media and increasing mobile penetration in China are deepening the cultural shift towards social commerce.

Potential Reach on Social Media Channels in China

The colossal potential reach on social media and increasing mobile penetration in China are deepening the cultural shift towards social commerce.

Simultaneously, counterfeiters are also diversifying to social media channels due to:

1. Improved enforcement strategies by e-commerce channels.

2. Increase in the amount of time spent by buyers on social media.

3. Ease of creation, marketing and deletion of fake accounts.

Social commerce is a perfect platform for “new-age parents” who rely more on online experts, user reviews, micro-influencers (KOL’s) and online communities. In 2020, QuestMobile reported a 13% YoY in time spent by Chinese parents on the internet. There is also a surge reported in their online shopping behaviour, making them an easy prey to new counterfeiting strategies. Due to the lack of monitoring and control on user generated content, counterfeiters can use social media platforms to advertise their knock-off brands and be able to link ads to their covert listings on e-commerce platforms.

Evolving online shopping landscape is also creating new opportunities for counterfeiters. With live streaming revolutionising online shopping in many parts of the world, live commerce market in China is now worth USD$60 billion a year. The ongoing movement restrictions have fuelled the live stream frenzy across Asia. However, recent reports have shed light on the increasing concerns with this format. Influencers and Key Opinion Leaders are sometimes diluting brand perception or supporting sales of counterfeits due to the lack of monitoring on those platforms.

In 2020, the China Consumers Association criticised an influencer for selling a product on a livestream broadcast for RMB$2,448 when it costed RMB$2,398. Local Nanjing police authorities across China and South East Asia have seized several international brands from a large warehouse, including over 300,000 goods counterfeiting famous fashion brands worth nearly RMB$200 million (almost USD$29 million).

Several mobile applications on Chinese app stores such as Zhiduoshao offer to verify vulnerable product categories, including fashion luxury goods, baby care products and electronics. However, it is reported that authentication applications have fake reviews that sell knock-offs. A 2018 US Government Accountability Office (GAO) report on counterfeits stated that almost 50% of the products purchased from third-party sellers with good ratings were confirmed by the IP owners as FAKE. Sophisticated strategies adopted by counterfeiters are pushing parents into buying sub-standard products.

Offline

Over the last two years, Chinese administrative and enforcement authorities have carried out several raids in response to complaints regarding fake baby care products. In January 2021, the Pinghu Administration for Market Regulation (AMR) of Zhejiang province inspected and confiscated 16 Hegen baby bottles from a store in response to a received complaint. The administrative enforcement authority imposed a fine of RMB$25,000 as the seller could not provide supplier qualification certificate or any proof for the legitimacy of its products.

Apart from raids resulting in moderate to high fines, arrests were made for crimes of producing and selling inferior goods. In March 2020, Zengcheng District of Guangzhou AMR and the police jointly raided and arrested 2 suspects from an underground factory where workers were falsifying production dates and the QR codes of milk powder of four well-known baby milk powder brands.

In October 2019, Jinshan Branch of Shanghai Police collaborated with the police in Guangdong, Henan and Anhui provinces, they raided 18 production and distribution premises that formed an illegal supply chain of counterfeit baby-care products. The joint forces seized over 150,000 baby bottles, 200,000 feeding bottle nipples and other products that is worth RMB$50 million. 32 suspects were arrested for committing crimes of counterfeiting registered trade marks, selling products counterfeiting registered trade marks, and selling illegally-made labels of registered trade marks.

The State Administration of Market Regulation (SAMR) has also deployed the 2021 protective measure for the safety of child and student supplies. This measure focuses on children’s toys, protective gear, clothing and other products that are closely related to children’s safety and health. The need for such supervisions is demonstrated by the national recall data. According to the published data in relation to nationwide automobile and consumer goods recall, 962,000 pieces of child products were recalled in 147 incidents of AMR-ordered recall in 2020.

Online

According to the XinHua News Agency report on 30 May 2021, the SAMR has also tried to strengthen supervision over selling of baby-care products on online platforms. In the first half of 2021, the 12,315 national online consumer complaint platforms received 51,600 complaints in relation to baby-care products. The local AMRs imposed fines of RMB$216,600 in total on the offending traders and recovered over RMB$2,230,300 of consumer losses.

The Chief Pangjin of the Online Transaction Supervision Department of the SAMR, expressed that they will continue to strengthen supervision of the online baby products through the following measures:

In response to increasing administrative supervision, platforms execute actions to fulfil their duties of compliance and social responsibility for baby-care product safety: Tmall and JD platforms require 3C certificates and test reports of the baby/child products to be provided to domestic consumers. They also conduct sample inspections to make sure their online stores are selling goods that comply with relevant laws and policies.

On 28 August 2019, Hangzhou Intermediate People’s Court rejected the claims by an individual Mr. Hu in the first internet administrative litigation for refusing the punishment decision made by Jiaxin AMR. The AMR confiscated the illegal milk powder sold by Mr. Hu through his online Taobao store and imposed a fine of RMB$427,371.20.

In another instance Shanghai Jiading Court sentenced an individual to a one year and three months imprisonment plus a fine of RMB$80,000 for selling counterfeit baby bottles and feeding bottle nipples that carry the Japanese brand ”Pigeon/贝亲” through his online Xianyu store.

Globally, baby care brands are changing the market dynamics through constant innovations and advanced technology to improve product quality, convenience, and customer satisfaction.

From an ergonomically designed high chair or a new design for orthodontic pacifier to a natural, paraben free baby shampoo, the baby care industry is witnessing unprecedented era of innovation. Innovation requires protection to thrive. The administrative and criminal action decisions demonstrate the government’s commitment in protecting Intellectual Property Rights (IPRs). However, protecting your innovation in China goes beyond than merely securing your Intellectual Property rights.

Marketplaces with third-party sellers are flooded with counterfeits, knock-offs, and scammers. The flow of counterfeits from Chinese manufacturing plants to Chinese e-commerce platforms is only part of the problem. There is also a rising concern of knock-offs manufactured in China and retailed through interchangeable storefronts on Amazon, such as opening new accounts to replace those that got shut down for violations.

Counterfeiters are becoming smarter at exploiting loopholes in the system. They can maintain sales channels on platforms and tear down genuine IPRs through advanced methods of reverse engineering. Thus, marketing and selling your innovative products and services in China require much more than basic IPR protection. For foreign brands entering China with innovative baby care equipment, patent applications for both core and auxiliary technology should be filed at the China Intellectual Property Office (IPO).

Current measures remain limited in combating counterfeits. Foreign IP owners selling their products in sensitive categories need to re-consider their existing enforcement strategies, specifically these tips:

[1] Global Baby Products Market Report 2020-2027

[2] https://daxueconsulting.com/parents-in-china/

[3] https://www.worldtrademarkreview.com/anti-counterfeiting/livestream-e-commerce-risk-and-opportunities-in-chinas-latest-brand-marketing-craze

[4] http://m.cqn.com.cn/ms/content/2021-02/22/content_8668109.htm

[5] http://www.cmrnn.com.cn/content/2021-06/10/content_202926.html

[6] http://www.ce.cn/xwzx/fazhi/201912/24/t20191224_33962795.shtml

[7] https://www.sohu.com/a/471017751_99983400

[8] https://baijiahao.baidu.com/s?id=1701166204678212930&wfr=spider&for=pc