Introduction

In December 2024, the State Council issued the "Opinions on Comprehensively Deepening the Reform of the Supervision of Drugs and Medical Devices to Promote the High-Quality Development of the Pharmaceutical Industry" ([2024] No. 53). These opinions emphasize the need to accelerate the patent portfolio for innovations in drugs and medical devices, and to enhance both the quality of patents and the efficiency of their transformation and application

In 2024, the National Medical Products Administration (NMPA) of China approved 228 new drug applications (NDAs), with 107 (47%) submitted by domestic pharmaceutical companies. This marks a significant increase from 2023, when 75 domestic NDAs accounted for 39% of the total (https://doi.org/10.1038/d41573-025-00028-8), and reflects the transformation of China's pharmaceutical market from "imitation and following" to "innovation and protection." During this transformation, innovative pharmaceutical enterprises face the challenge of achieving comprehensive protection for their products through effective patent filing strategies and portfolio management. This is crucial for ensuring a smooth path to product commercialization.

Dapagliflozin, a groundbreaking medicine for treating type II diabetes, is globally commercialized by AstraZeneca (hereinafter referred to as “AZ”). Although its drug compound patent in China expired in 2023, AZ's 2024 annual report revealed that dapagliflozin achieved record-high sales of approximately $500 million (3.5 billion RMB) in China's oral antidiabetic drug market.

This phenomenon defies the conventional expectation of a patent cliff for branded drugs. The exemplary patent portfolio management of dapagliflozin in China offers a valuable case study.

Breakthrough in Diabetes Treatment

Dapagliflozin is the first SGLT2 inhibitor approved globally for the treatment of type II diabetes. As a phenyl glucoside compound, its unique mechanism of action involves inhibiting the reabsorption of glucose in the kidneys, allowing excess sugar to be excreted through urine. This non-insulin-dependent hypoglycemic pathway has opened new doors for diabetes treatment. Clinical data from China shows that Dapagliflozin can reduce glycated haemoglobin by up to 0.8%, which is significantly higher than traditional drugs (https://endo.dxy.cn/article/68251).

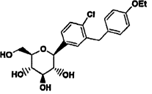

Chemical structure of Dapagliflozin

Market Expansion Strategy of Dapagliflozin

After its approval in China in 2017, dapagliflozin was included in the national medical insurance in 2019 through negotiations with the National Healthcare Security Administration, resulting in a price reduction of over 20%. Dapagliflozin became the first SGLT2 inhibitor in China to be covered by medical insurance.

Although this strategy reduced the drug price to the lowest in the world — with a single tablet in the United States being six times more expensive than in China — the "price-for-volume" strategy had an immediate effect. According to its annual report, dapagliflozin had covered 80% of first-class hospitals nationwide by 2023, with annual sales exceeding 3.5 billion RMB (almost half a billion USD), accounting for nearly 10% of the global market share.

More notably, its strategy of expanding indications has been successful. Initially approved for treating type II diabetes, dapagliflozin received approval for chronic kidney disease as a new indication in 2022, tripling the patient population covered and demonstrating a market growth model driven by clinical value.

Comprehensive Patent Portfolio in China

The dapagliflozin compound was initially developed by Bristol-Myers Squibb (BMS) in the United States. Its patent was first filed in the United States in May 2002 (US10/151436), followed by a PCT application (WO2003099836A1), and then nationalized in China in 2004 (CN03811353.8). For better commercialization, BMS transferred the dapagliflozin-related patents to AstraZeneca (Sweden) Limited in 2014.

Due to the early filing date of the dapagliflozin compound patent and strict drug registration and approval procedures, the drug's market entry was delayed. When dapagliflozin was approved for marketing in China in 2017, it faced the challenge of its compound patent expiring within five years, in May 2023. To mitigate the impact of the shortened patent protection period, a comprehensive filing strategy was implemented to build a robust patent portfolio around the dapagliflozin product.

A protective system of 26 Chinese patents/applications has been built around dapagliflozin, including:

These patents focus on the phenyl glucoside compound structure. Multiple divisional applications provide cross-protection, covering the dapagliflozin molecule and its preparation intermediates, forming a "solid barrier" for generic drug R&D.

These patents comprehensively protect the synthesis routes of various SGLT2 inhibitors, including dapagliflozin. Utilizing an acetyl protection strategy, they offer a preparation method with high purity and yield. Divisional applications cover preparation methods for key process intermediates, creating multi-layer patent protection.

Various solvates of dapagliflozin crystals were developed. Innovatively, the S-configuration of propylene glycol was selected to form a solvate crystal with dapagliflozin, resulting in a stable crystal form suitable for industrial formulation, addressing dapagliflozin's poor crystallization. Divisional applications protect other new types of dapagliflozin solvates, building a comprehensive patent barrier to prevent the design of alternative solvates for circumvention.

Using dapagliflozin S-propylene glycol solvate as the core component, these patents achieve a stable oral dosage form. This product is currently the only formulation in the world using propylene glycol solvate as the active ingredient. This innovation resolves the technical challenge of dapagliflozin's formulation, ensuring a stable and effective oral formulation. Together with the crystalline patents, these formulation patents form core patents that are difficult for generic drugs to circumvent, ensuring consistent drug efficacy.

Twelve different pharmaceutical use patents cover various indications such as heart failure, chronic kidney disease, hyperuricemia, and diabetes prevention, forming a closed loop of patent protection by exploring new therapeutic areas.

This "basic protection + technical blockade + market extension" three-layer patent protection structure provides a comprehensive 360-degree protection system for the dapagliflozin product.

Patent Filing Strategy from Dapagliflozin case

Dapagliflozin has established a robust barrier through kernel layer patents (compounds and process patents), while peripheral layer patents (crystalline, formulations, indications) provide extended protection. Technically and legally, this setup creates multiple barriers against the production of generic drugs.

High threshold for technical circumvention

Dapagliflozin's crystalline and formulation patents significantly elevate the R&D threshold for generic drugs. For instance, preparing even a simple polymorph of dapagliflozin is challenging. Generic drug companies aiming to circumvent the patent protection of innovative drugs must invest several years in developing a new alternative crystalline form of dapagliflozin. However, the development of a new crystalline form is highly unpredictable and may fail due to insufficient stability during bioequivalence verification. This technical barrier extends the R&D cycle of generic drugs by an average of 3 to 5 years, far exceeding the gap period following the expiration of the compound patent.

Continuous legal and litigation pressure

According to China's drug patent linkage system, generic drug companies must offer a patent declaration of "pending approval to market" or "challenging the patent validity" when applying for approval before launching into the market. This forces competitors into a cycle of "declaration - litigation - validity challenge," effectively delaying market competition. Data from 2024 shows that among the 34 patent invalidation requests against dapagliflozin, only one medical use patent was fully invalidated, with over 80% of core patents maintained. Generic drug companies that fail to challenge the formulation patents not only bear high litigation costs but may also face postponed marketing plans.

Extension of market exclusivity

Through "patent relay", the market exclusivity of dapagliflozin was extended from 2023 to 2028. After the compound patent expired, crystalline form and formulation patents formed the second line of defense, and patents for new indications such as chronic kidney disease further extended the protection period. The success of this strategy is directly reflected in the sales data. Even in the face of generic drug competition, dapagliflozin still topped the market with 3.5 billion RMB (about a half billion USD) in sales in 2023, demonstrating the strong extension of dapagliflozin's market exclusivity through strategic patent portfolio management.

Takeaways for the Pharmaceutical Industry

The success of dapagliflozin in the Chinese market demonstrates how multinational pharmaceutical companies can leverage systematic patent portfolio management and legal strategies to compete with generic drugs. Faced with the expiration of the core compound patent, the branded drug company extended the product's exclusivity period to 2028 through strategic patent portfolio structuring, legal offense and defense, and policy coordination. This provides a replicable strategic example for innovative pharmaceutical companies.

Dapagliflozin's patent portfolio management also signals that China's pharmaceutical market has entered a stage where "competition on innovation quality" runs parallel to "gaming via patent portfolio." For local Chinese pharmaceutical companies, it is imperative to break the passive mindset of "circumventing patents" and shift to a proactive filing strategy of "patenting for innovation." They need to plan a "four-dimensional protection system" covering compounds, crystalline forms, formulations, and indications from the very first stage of new product R&D initiation. Moreover, they should establish a linkage mechanism of "R&D - patent - market" and deeply integrate patent portfolio into product life cycle management. Only by this approach can they truly transition from "technology followers" to "standard setters."

Disclaimer: This article discusses the patent filing and portfolio management strategies of this drug solely from the patent perspective and does not address other factors.