The detention of infringing goods by Customs has been an important tool in protecting IP in China. Over the past ten years (from 2012 to 2021), the number of IP related seizures by China Customs has increased from 18,000 in 2012 to 84,000 in 2021, a seven-fold increase. In 2018, IP related seizures actually jumped 220% (to 49,700 compared to 22,500 interceptions in 2017), mainly due to the boom in cross border e-commerce. Most of these are export shipments, destined all over the world. Understanding emerging trends is therefore critical for IP owners wishing to track and disrupt the flow of counterfeit goods.

Every year China Customs releases an IPR Protection White Paper, which reports on macro level data and contains indicators of IPR protection trends in the country. For example, the 2021 White Paper revealed that the number of detained goods infringing patents has increased, as has the number of goods infringing copyright. This illustrate how China Customs are protecting a range of IP rights beyond trademarks.

However, the detention of goods does not necessarily confirm infringement when presented without information on subsequent actions and fines. The China Customs White Paper records the ‘interception’, but not necessarily the result. To better understand infringing goods being seized, the best source is the information in the ‘punishment decisions’ (PD) issued by the authorities.

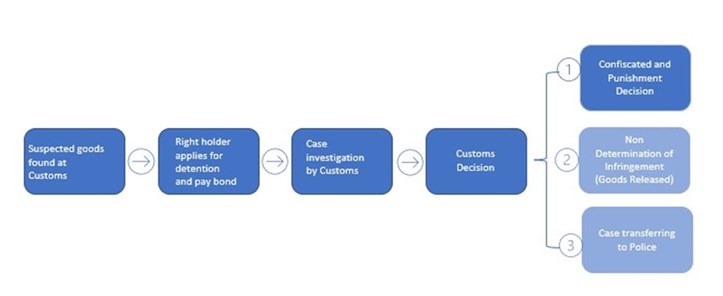

China Customs’ process in issuing PDs

When enforcing IP rights, China Customs adopts a four step process after a seizure:

A punishment decision is made if the detained goods are ruled to be infringing. A punishment decision will not be issued, if:

China Customs' process in issuing punishment decisions

Source: Rouse

The data from punishment decisions

In 2014, China Customs began to publish its IP-related punishment decisions publicly (PDs with state or commercial secrets are excluded). Since then, Rouse has been archiving the data in its enforcement analysis database Chorus.

There are 42 Customs entities in China, directly led by the General Administration of Customs. For our database we 21 with high traffic volume to track their PDs. In total, from 2014 to 2021, data from over 10,000 PDs was collected.

The resulting dataset reveals some important findings. Below are answers to some of the commonly asked questions about Customs PDs.

In a case where Customs finds infringement, the goods are confiscated and destroyed. Besides confiscation, Customs may also impose a fine of up to 30% of the declared value of the seized infringing goods. From the PDs we analysed, the most common percentage is 10-15% of the value.

Since 2014, the highest fine recorded was in 2015 for RMB400,000. This particular PD came from Zhenjiang Customs against a company which was exporting counterfeit CONCH cement to Gabon. In this case, the infringer was using a confusingly similar mark, CGNAH. Besides the high fine, this PD is a good reference for a Customs’ decision on confusingly similar marks.

Unfortunately, this type of high of penalty is only found in a small number of PDs. One reason is due to the trend towards smaller shipments of lower value, driven by e-commerce. In recent years, Customs has been allocating additional resources and attention to taking action against postal, courier and e-commerce parcels, leading to seized goods with fairly low values.

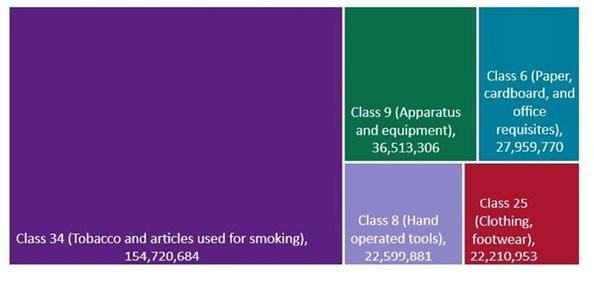

By classifying the goods focused on in the PDs, Class 34 (tobacco and articles for smoking) had the highest number of infringing goods seized and fined by China Customs.

Class 9 (apparatus & equipment including IT goods), Class 6 (paper and cards, office requisites), Class 8 (hand operated tools) and Class 25 (clothing & footwear) rounded out the top five classes with the highest quantities of infringing goods seized and fines.

Quantity of infringing goods seized and fined, classified by trademark Class (2014-2021)

Source: Rouse

Separately Class 25 (clothing & footwear), Class 9 (apparatus & equipment), Class 18 (leather & goods made of leather), Class 7 (machine & machine tools) and Class 3 (toiletry preparation) made up the list of goods categories which received the most PDs.

While the value or significance of one item fined might differ from one type of goods to another (eg, a piece tobacco package paper vs a computer), we believe that goods in Chart 2 are products more frequently intercepted, seized and finally fined by China Customs. That makes sense since China’s production of clothing & footwear is huge, as its dominance of IT goods production.

We have looked at some common product categories to see if there are categories which are seemingly more protected than others.

From 2014 to 2021, Samsung, Murata, UL, Apple & Philips are the right holders who have been most successful in terms of the quantity of goods infringing their rights being seized and fined.

Top five rights holder in terms of seized and fined infringing goods in the electronic goods category, from 2014 to 2021.

|

Rights holder |

Number of seized and fined infringing goods (2014-2021) |

|

Samsung |

12,920,167 |

|

Murata |

5,784,675 |

|

UL |

4,227,302 |

|

Apple |

663,489 |

|

Philips |

463,550 |

Looking at PD frequency, Netac Technology, SD-3C, Xiaomi, Huawei, and Oppo are rights holders with more PDs than other brands in recent years (2019-2021). These are all Chinese electronics goods producers, likely with big teams active with Customs, and able to get to and work with ports.

From 2014-2021, Gucci, Adidas, Nike, Puma and Havaianas are the top five right holders in terms of seizures and fines against those infringing their rights.

Top five rights holder in terms of seized and fined infringing goods in the apparel & shoe category, from 2014 to 2021.

|

Rights holder |

Number of seized and fined infringing goods (2014-2021) |

|

Gucci |

4,136,591 |

|

adidas |

2,386,542 |

|

Nike |

2,132,140 |

|

Puma |

898,433 |

|

Havaianas |

712,442 |

Looking at PD frequency, Chanel, Louis Vuitton Malletier, and Christian Dior are also rights holders benefiting from more PDs than others in recent years (2019-2021). This probably reflects both the fame of these brands as well as the activity of their anti-counterfeiting teams.

From 2014-2021, Disney Enterprise, Universal Studio, Lego, Nintendo and Peanuts Worldwide top the list of those benefitting from the largest quantity of infringing goods seized and fined.

Top five rights holder in terms of seized and fined infringing goods in the Toy category, from 2014 to 2021.

|

Rights holder |

Number of seized and fined infringing goods (2014-2021) |

|

Disney Enterprise |

216,911 |

|

Universal Studio |

90,231 |

|

Lego |

81,252 |

|

Nintendo |

71,432 |

|

Peanuts Worldwide |

63,988 |

Looking at PD frequency, Viacom, Takara Tomy, Spinmaster and Hasbro are rights holders benefitting from more PDs than other brands in recent years (2019-2021).

From 2014-2021, the top five Customs ports (in terms of the number of PDs issued) are:

While Shanhgai, Ningbo and Shenzhen are huge ports, Hangzhou and Guangzhou are not. Their presence on the list reflects their higher than normal activity levels.

Customs issuing the most punishment decisions (2014-2021)

|

Customs |

Number of punishment decisions |

|

Ningbo |

2,665 |

|

Shenzhen |

1,674 |

|

Hangzhou |

1,299 |

|

Shanghai |

962 |

|

Guangzhou |

745 |

|

Huangpu |

680 |

|

Nanning |

505 |

|

Xiamen |

480 |

|

Urumqi |

423 |

|

Gongbei |

304 |

The punishment decisions show that 99% of fined entities were exporters or some kind of shell company. This underlines a major weakness in China Customs seizures: that the producers and the goods owners (when this is different) are not being caught or fined in most cases. To track the manufacturer or real owner behind the exporter/shell company, a round of investigations is required. The data therefore underlines how important tracing the sources is.

Another strategy for IP holders is tracking containers of infringing goods, to facilitate controlled delivery and seizure by Customs. This can be an effective way to prevent goods leaving China.

Takeaways

Publication of data is helpful to bring transparency to Customs IP enforcement activities. In one sense, publication of Customs punishment decisions serves as a deterrent. But IP owners can also use the data to learn what others in their sector are doing, and which ports are most effective.

Customs seizures cause disruption the counterfeit goods supply chain, and mean that someone loses the value of the goods. Increasingly in today’s world of sourcing, a trader orders goods from a factory, one of many they order from. Seizing the goods impacts these invisible, often virtual, businesses which are behind much of the world’s counterfeit trade.

The data also shows how important proper investigations into sources are. IP owners who want to be more strategic in enforcement need to go beyond seizures to target the goods owners (who might be traders), or the producing factories.

While we look forward to seeing progress in data collection and publication, IP holders must not forget the key pillars of a Customs protection program in China:

Having this base in place will enable a more careful approach, using data to throw a wider net over counterfeiting.

This article was first published by World Trademark Review in February 2023.